When you’re raising capital, the number one question that keeps founders up at night is: “How much am I giving up?”

Guessing is risky. Spreadsheets are brittle. And 2 a.m. algebra is nobody’s hobby. That’s where a dilution calculator comes in handy. It instantly shows how a fundraising round changes ownership among stakeholders.

Below, we’ll walk through the math by hand first, then show you how you can validate it in seconds using Mantle’s free dilution calculator.

What is Dilution?

Dilution happens when your company issues new shares, usually during a fundraising round. The more shares you issue, the smaller slice of the pie each existing stakeholder gets.

Here’s a simple example (no pool, no SAFEs):

- Founders: 10M shares (100% ownership)

- Raise: $2M at an $8M pre-money valuation via a SAFE

After conversion, the investor owns 20% of the company, and founders retain 80%.

Simple enough, right?

Real life is rarely this simple: option pool top-ups, SAFEs/notes, multiple investors, and multi-round compounding all make dilution tricky to calculate. That’s why a dilution calculator can save hours of work.

How to Calculate Dilution by Hand

Even if you plan to use a dilution calculator, knowing the basics helps founders negotiate confidently.

Case 1: Simple Priced Round (No Pool Change, No SAFEs)

Inputs

Pre-money valuation (Pre): $8,000,000New cash (Cash): $2,000,000Existing fully diluted shares (S₀): 10,000,000Steps

Price per share (PPS)

- PPS = Pre/S₀

- PPS = 8,000,000/10,000,000

- PPS = $0.80

Investor shares (X)

- X = Cash/PPS

- X = 2,000,000/0.80

- X = 2,500,000

Post-money shares (T)

- T = S₀+X

- T = 10,000,000 + 2,500,000

- T = 12,500,000

Ownership

- Investor = X/T = 20%

- Founder = S₀/T = 80%Here’s an example of a spreadsheet showing the transition from a 100% slice of the pie to an 80% slice.

Case 2: Priced Round with Option Pool Top-up to a Target % Post-Money

Investors often require a post-money option pool target (e.g., 15%). This adds extra shares to the option pool before pricing the round, increasing founder dilution.

Key steps:

- Calculate the extra poool shares to meet the target.

- Determine the new price per share.

- Calculate the investor shares.

- Compute the final ownership: investors, founders, and the pool.

Using a dilution calculator makes this process fast and error-free.

Inputs

Pre = $8,000,000

Cash = $2,000,000

S₀ = 10,000,000 shares

Target pool post-money (t) = 15%Unknowns

Y = Extra pool shares to add

X = Investor sharesSet up

PPS = Pre / (S₀ + Y)

X = Cash / PPS = Cash⋅(S₀ + Y) / Pre

Post-money shares: T = S₀ + Y + X

Enforce pool target: Y / T = tSolve

X = 2,000,000⋅(10,000,000 + Y) / 8,000,000

X (Investor Shares) = 2,500,000 + 0.25Y

T = 10,000,000 + Y + (2,500,000 + 0.25Y)

T (Post-Money Shares)= 12,500,000 + 1.25Y

Y / T = 0.1

Y = 0.15 (12,500,000 + 1.25Y)

Y (Extra Pool Shares to Add) = 2,307,692

PPS = 8,000,000 / (10,000,000 + 2,307,692)

PPS (Price Per Share) ≈ $0.65

X = 2,000,000 / 0.65

X (Investor Shares) ≈ 3,076,923Ownership

Investors: X / T ≈ 3,076,923 / 15,384,615 = 20%

Pool: Y / T = 15%

Founders: 100% - 20% - 15% = 65%Case 3: What about SAFEs & Notes?

SAFEs and Convertible Notes add complexity: pre-money vs. post-money SAFEs, valuation caps, discounts, and accrued interest.

Here’s the general flow:

- Convert SAFEs/notes using their conversion price:

- Conversion Price = min(Cap Price, Discounted Round Price) per the instrument

- Add the resulting SAFE/Note shares to the pre-money capitalization.

- If there’s a pool target, top it up next (like Case 2).

- Price new money off the updated pre-money share count.

Manually tracking all this in a spreadsheet can break easily. Use Mantle’s dilution calculator to handle these automatically.

Case 4: Multi-Round Dilution

So far, we’ve only looked at one round at a time. However, dilution compounds across multiple raises.

Example:

- Seed Round: $2M at $8M pre → Investor = 20%, Founders = 80%

- Series A: $10M at $40M pre → Investor = 20% of the new post-A shares

At first glance, both rounds look like the “same” 20% dilution. But here’s what really happens:

- After Seed: Founders = 80%

- After Series A: Founders = 64% (20% × 80%)

That compounding effect sneaks up fast. Add an option pool refresh or a SAFE conversion between rounds, and the math gets messier.

Takeaway: You can’t just eyeball “20% each round” and assume you’ll know your final ownership. Multi-round modeling is where tools like Mantle’s calculator save you from spreadsheet gymnastics and can be used per round to avoid surprises.

Why You Need a Dilution Calculator

Yes, you can do all this in Excel, but it often breaks when:

- Adjusting pool targets or SAFE terms

- Modeling multiple scenarios

- Sharing with investors or board members

- Additional complexity from tracking your entire option plan, vesting schedules, and exercises in the same sheet

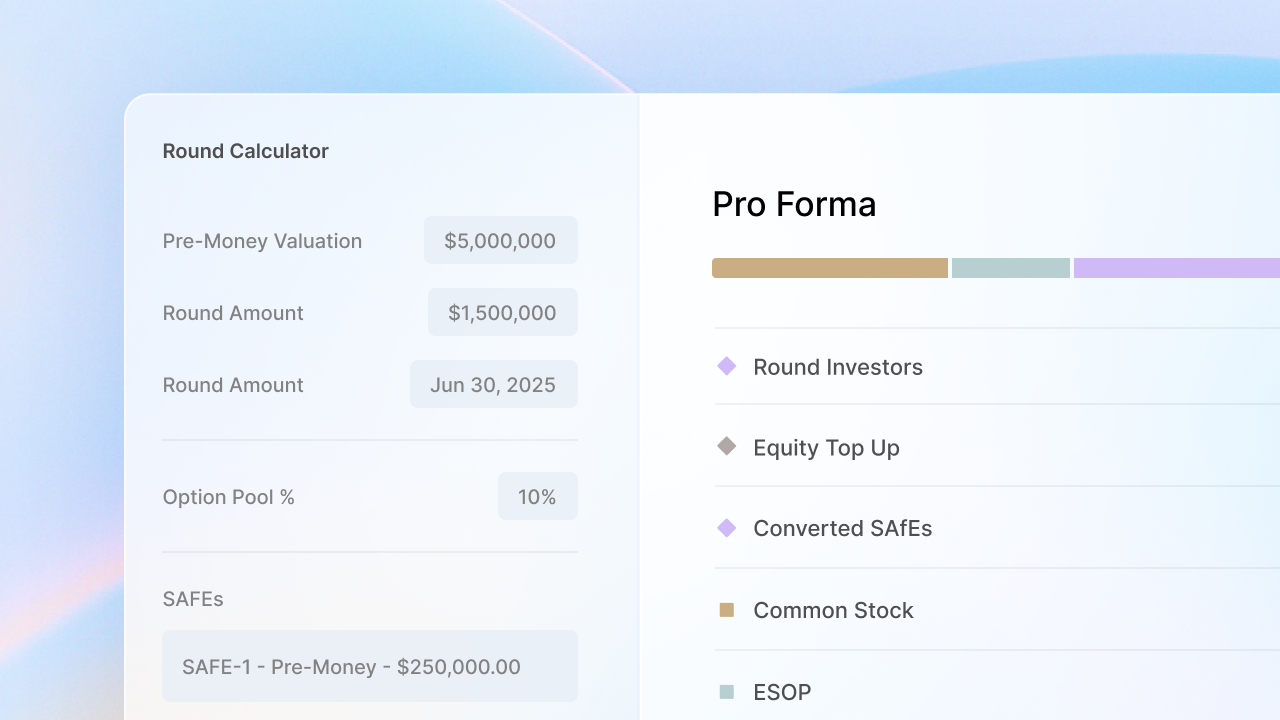

Mantle’s dilution calculator solves this instantly:

✅ Accurate and automatic calculations

✅ Handles SAFEs and option pools

✅ Scenario comparison to evaluate different fundraising strategies

✅ Founder-friendly outputs: see dilution, valuation, and ownership at a glance

👉 Try Mantle’s Free Dilution Calculator

Bottom Line

Equity is your most valuable currency as a founder. Don’t lose track of it by guessing or wrestling with spreadsheets. Use a dilution calculator to gain clarity, confidence, and a sanity check before signing term sheets.

Take control of your equity with Mantle

Create your free account to track your ownership, model dilution, and manage shares, options, SAFEs, and more—all in one place.

Amit Jethani is a co-founder and runs Operations at Mantle.

Disclaimer: This blog post is provided as general information to clients and friends of Mantle. It should not be construed as, and does not constitute, financial, legal or tax advice on any specific matter, and employers and employees should always consult their professional advisors, accountants or attorneys as needed when considering decisions or actions that may impact their business or personal interests. Mantle does not assume any liability for reliance on the information in this blog post.